TEMPO.CO, Jakarta - Lis, 58 years old, has just heard about the freezing of tens of thousands of dormant or inactive accounts for a minimum of 3 months by Indonesia's Financial Transaction Reports and Analysis Center (PPATK). She is worried that her account is among those frozen because it has been inactive for years.

The Bekasi resident said she saved in a government bank to prepare for covering the costs of performing the Hajj pilgrimage if she receives a call to perform the religious duty in the Holy Land.

Although guaranteed that the savings will not be disturbed, Lis and thousands of other customers seem to have to take the time to arrange the reactivation of their accounts temporarily frozen by PPATK. There are two forms to fill out and five documents to upload.

The required time is also not short. The estimated time needed is five business days, but it may take up to 15 business days depending on the completeness and accuracy of the data, as well as the review results by PPATK and the bank. "So the total estimated time is 20 working days," wrote PPATK via an official post on the @ppatk_indonesia Instagram account, quoted on Monday, July 28, 2025.

Some parties have criticized this PPATK measure. However, the institution argues that freezing these inactive accounts is part of the National Movement for the Prevention and Eradication of Money Laundering and Terrorism Funding carried out by PPATK.

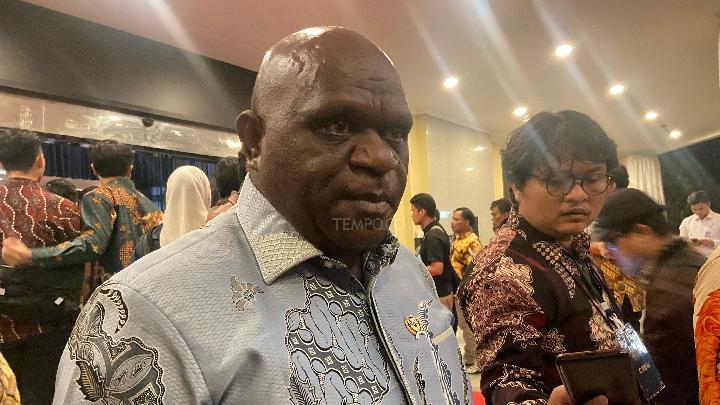

"We are protecting the accounts of the public that are classified as dormant according to the banking data we receive so that they are not misused by unauthorized parties," said PPATK Chief Ivan Yustiavandana as quoted from Antara, Sunday, May 18, 2025.

In 2024, PPATK has frozen a total of 28,000 dormant accounts. According to Ivan, this step aligns with the mandate of Law Number 8 of 2010 concerning the Prevention and Eradication of Money Laundering (TPPU).

Ivan also said that, according to Law 8/2010, the PPATK has the right to halt suspicious transactions.

Vulnerable Inactive Accounts

The purpose of freezing accounts is to prevent financial criminals from misusing them. Dormant accounts are susceptible to money laundering and other illegal transactions.

This freezing is carried out to protect the public and the financial system. "PPATK has found many dormant accounts that have been misused, such as the sale and purchase of accounts or used for money laundering criminal acts," wrote PPATK in an official post on the @ppatk_indonesia Instagram account, quoted on Monday, July 28, 2025.

The frozen dormant accounts can be in the form of savings accounts (personal or corporate), checking accounts, or rupiah/foreign currency accounts. Despite being frozen, PPATK stated that the customers' funds are still safe and have not been lost.

The freezing of inactive accounts is due to the discovery of the sale of accounts for illegal activities such as online gambling and other money laundering activities. According to records from the PPATK, more than one million accounts suspected of involvement in criminal activity have been identified since 2020, as reported by Antara on Wednesday, July 30, 2025.

More than 150,000 of them are nominee accounts obtained through the sale and purchase of accounts, hacking, or other unlawful means.

These accounts are then used to accommodate funds from criminal acts and become inactive (dormant).

Meanwhile, over 50,000 accounts have been recorded as having no transaction activity before receiving illegal funds.

The PPATK also found that more than 10 million social assistance recipients have not used their accounts for over three years.

Social assistance funds totaling Rp2.1 trillion are lying dormant, suggesting that they have not been distributed effectively.

Anastasya Lavenia Yudi contributed to the writing of this article

Editor's Choice: AJI Batam Condemns Fictitious Order "Terror" Against Riau Islands Media

Click here to get the latest news updates from Tempo on Google News

AGO Questions 13 Witnesses Regarding Loan to PT Sritex

7 hari lalu

The Attorney General's Office (AGO) examined 13 individuals in the case of corruption related to credit disbursement by several banks to PT Sritex

AGO Names 8 New Suspects in Sritex Credit Corruption Case

8 hari lalu

The number of suspects in the Sritex credit corruption case has now reached eleven people.

PPATK Reveals 550,000 Social Aid Beneficiaries Involved in Online Gambling

24 hari lalu

PPATK disclosed that 550,000 people receiving social aid in 2024 were actively involved in online gambling.

Muhammadiyah Hopes to Establish Sharia Commercial Bank, Says Leader

27 hari lalu

The Chair of the Central Leadership of Muhammadiyah, Anwar Abbas, stated that Muhammadiyah hopes to establish a Sharia commercial bank.

OJK Receives 153,000 Financial Scam Reports

34 hari lalu

The OJK has received over 153,000 financial fraud reports with victims suffering trillions of rupiah in losses.

Bank Woori Saudara Suspected of $78.5 Million Fraud, Management Says Still Investigating

48 hari lalu

PT Bank Woori Saudara Indonesia 1906 Tbk stated that the management is still delving into the allegations of a $78.5 million fraud or around Rp 1.28 trillion

Prabowo to Determine New Name for BTN Syariah After Acquiring Bank Victoria Syariah

51 hari lalu

President Prabowo Subianto will determine the name for the merged sharia public bank of BTN Syariah and Bank Victoria Syariah

KPK Questions Bank Jepara Artha Director in Rp250bn Fictitious Loan Case

56 hari lalu

The Corruption Eradication Commission (KPK) has scheduled an examination of President Director of PT Bank Perkreditan Rakyat Bank Jepara Artha

Police to Collaborate with PPATK to Trace Money Flow of Thuggery

28 Mei 2025

The Jakarta Metro Police plan to trace the money flow of thuggery that operates under the guise of mass organizations.

AGO Probes Corruption in Sritex's Rp3.58 Trillion Bank Credit

22 Mei 2025

Attorney General's Office (AGO) reveals its suspicion of corruption in the issuance of credit by several state-owned banks to textile company Sritex.